|

| How to register a family member as a dependent (dependent certification) |

|

|

|

| |

|

|  Under

the health insurance, insurance benefits are paid not only to

the insured person, but also to family members who are dependent

on the insured person. These family members are called "dependents," and

the family members who may become dependents are defined by law. Under

the health insurance, insurance benefits are paid not only to

the insured person, but also to family members who are dependent

on the insured person. These family members are called "dependents," and

the family members who may become dependents are defined by law.

*In principle, only residents of Japan are eligible (from April 1, 2020).

|

|

|

|

|

| |

|

In order to become a dependent, a person must be certified

by the Health Insurance Society. If you wish to make a member of your family a dependent, fill in the necessary details in the form below and send it together with the necessary documents to the Health Insurance Society within five days via your employer.

|

|

|

Procedural

Documents:

|

|

1.

|

"Notification

of Health Insurance Dependent (Change)"

|

|

2.

|

Other documents as required

|

|

|

|

*Submit the documents within five

days of the change.

|

|

|

|  Scope of qualifications

as a dependent Scope of qualifications

as a dependent

|

|

|

To qualify as a dependent of an insured person, an individual

must depend for his or her living primarily on the income of

the insured person.

Specifically, in order to meet this standard the person wishing

to become a dependent must have an annual income (i.e., total

income including benefits received from sources such as unemployment

insurance and pensions) less than the following base levels “(1)”

and “(2)”:

(1) When the prospective dependent lives with the

insured person:

The person wishing to become a dependent must earn less than

1.3 million yen per year (1.8 million yen if aged 60 or above, or a person with a disability that is eligible for receipt of Disability Employees' Pension benefits), and

his or her annual income must total less than half of the insured

person's income.

(2) When the prospective dependent does not live with

the insured person:

The person wishing to become a dependent must earn less than

1.3 million yen per year (1.8 million yen if aged 60 or above, or a person with a disability that is eligible for receipt of Disability Employees' Pension benefits, and

his or her annual income must total less than the amount of

funds sent to him or her by the insured person.

However, since those aged 75 and above are covered under the medical system for persons in the latter stages of old age, they are not eligible to become dependents under the health insurance system. |

|

● Government measures to address annual income barriers (starting in October 2023) |

|

|

■ What are annual income barriers? |

|

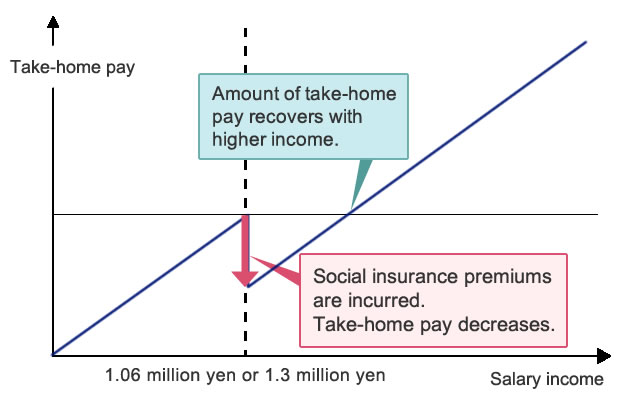

Annual income barriers refer to threshold income amounts that determine whether or not taxes and social insurance premiums are incurred.

Individuals who have dependent status and work part-time or other non-regular jobs will lose their dependent status if their annual income exceeds a certain figure, and become an insured person under a company health insurance plan, National Health Insurance, or other insurance system. They will then be required to pay social insurance premiums, which may result in lower take-home pay.

One of two different annual income barriers applies for social insurance premiums, depending on company size and other factors: 1.06 million yen or 1.3 million yen.

(Source: Provisional measures to address annual income barriers (Ministry of Health, Labour and Welfare))

|

| 1.06 million yen annual income barrier |

At companies with 51 or more employees, an employee will incur social insurance premiums if certain conditions, such as when monthly wages are 88,000 yen or more (i.e., annual income is approximately 1.06 million yen or more), are satisfied.

・Health insurance coverage for those working reduced hours (e.g., part-time employees)

|

| 1.3 million yen* annual income barrier |

Social insurance premiums are incurred automatically without exception, since the worker no longer meets the dependent eligibility criteria. |

* 1.8 million yen if aged 60 or above or with a disability eligible for receipt of Disability Employees' Pension benefits

|

■ Handling for the 1.3 million yen annual income barrier |

|

Although dependent certification is based on checking of taxation certificates and other documents from the previous year, if the worker’s annual income is expected to temporarily exceed 1.3 million yen due to longer hours because of labor shortage or other factors, the worker may choose to retain his or her dependent status simply by attaching a certificate from the employer.

(In principle, this handling is available no more than two consecutive times for a single worker.) |

|

■ Handling for the 1.06 million yen annual income barrier |

|

Companies that help increase worker income through means such as payment of allowances to encourage social insurance coverage* will be provided subsidies for a finite term. |

* Allowances to encourage social insurance coverage

These allowances are intended to encourage employee insurance coverage for those working reduced hours and to reduce the burden of insurance premiums when workers who had been ineligible for insurance are newly covered by insurance.

Allowances to encourage social insurance coverage are to be paid apart from salaries and bonuses. They are not considered when calculating the standard monthly remuneration or standard bonuses used to determine insurance premiums.

* Eligible persons: Those with standard monthly remuneration of 104,000 yen or less

* Maximum allowance amount excluded from standard remuneration: Amount equivalent to the insurance premiums newly incurred by the employee due to insurance coverage

* A time-limited measure not to exceed two years |

New requirement concerning residency in Japan for dependent certification New requirement concerning residency in Japan for dependent certification

|

|

From April 2020, a requirement related to residency in Japan is added to the requirements for certification of health insurance dependents. In principle, from April 1, 2020, those who do not have addresses in Japan cannot be certified as dependents (with certain exceptions - for example, students studying abroad). |

Determinations of residency are based on whether a person is registered to the basic resident register (i.e., whether or not the person has a certificate of residence). In principle, those who have certificates of residence in Japan meet the domestic residency requirement.

Note: Even those who have certificates of residence in Japan will not satisfy the domestic residency requirement if they clearly do not reside in Japan - for example, those employed overseas. |

Those whose livelihoods are recognized to be based in Japan, such as students studying abroad temporarily, are considered to meet the domestic residency requirement on an exceptional basis, even if they actually reside overseas.

[Cases qualifying as exceptions to the domestic residency requirement]

(1) Students studying abroad

(2) Family members accompanying an insured person posted abroad

(3) Those traveling abroad temporarily for sightseeing, recreation, volunteer activities, or other reasons unrelated to employment

(4) Those who enter into a family relationship to an insured person while the insured person is posted abroad

(5) In addition to those described under (1)-(4) above, others whose livelihoods are recognized to be based in Japan in consideration of purposes of traveling abroad and other circumstances |

Those who come to Japan on medical visas or on long-stay visas for sightseeing or recreational purposes cannot be certified as dependents, even if they reside in Japan. |

As an interim measure, if a person who would lose his or her eligibility as a dependent due to the addition of the domestic residency requirement is hospitalized in a medical care institution in Japan as of the date of enactment of the requirement (April 1, 2020), his or her eligibility will continue during the period of hospitalization. |

When a change occurs in information for dependents When a change occurs in information for dependents

|

|

When a family member once authorized as a dependent no longer satisfies the criteria due to employment, separation, or death, procedures are required to remove him or her from the list of dependents.

Procedures are also required to remove a dependent who has turned 75 from the list of dependents.

See here for details.

>> "When someone is no longer a dependent" |

|

|

|

|